This course is designed for those who want to earn consistent and high-probability returns. Mostly it is very much suitable for working people who are not able to monitor his trade during all of the trading hours. This course will help to earn on an average 4-5% monthly on your capital.

Day 1-4

- Basics of Options and Derivative market

- Options Basics (Call, Put, IV, open interest)

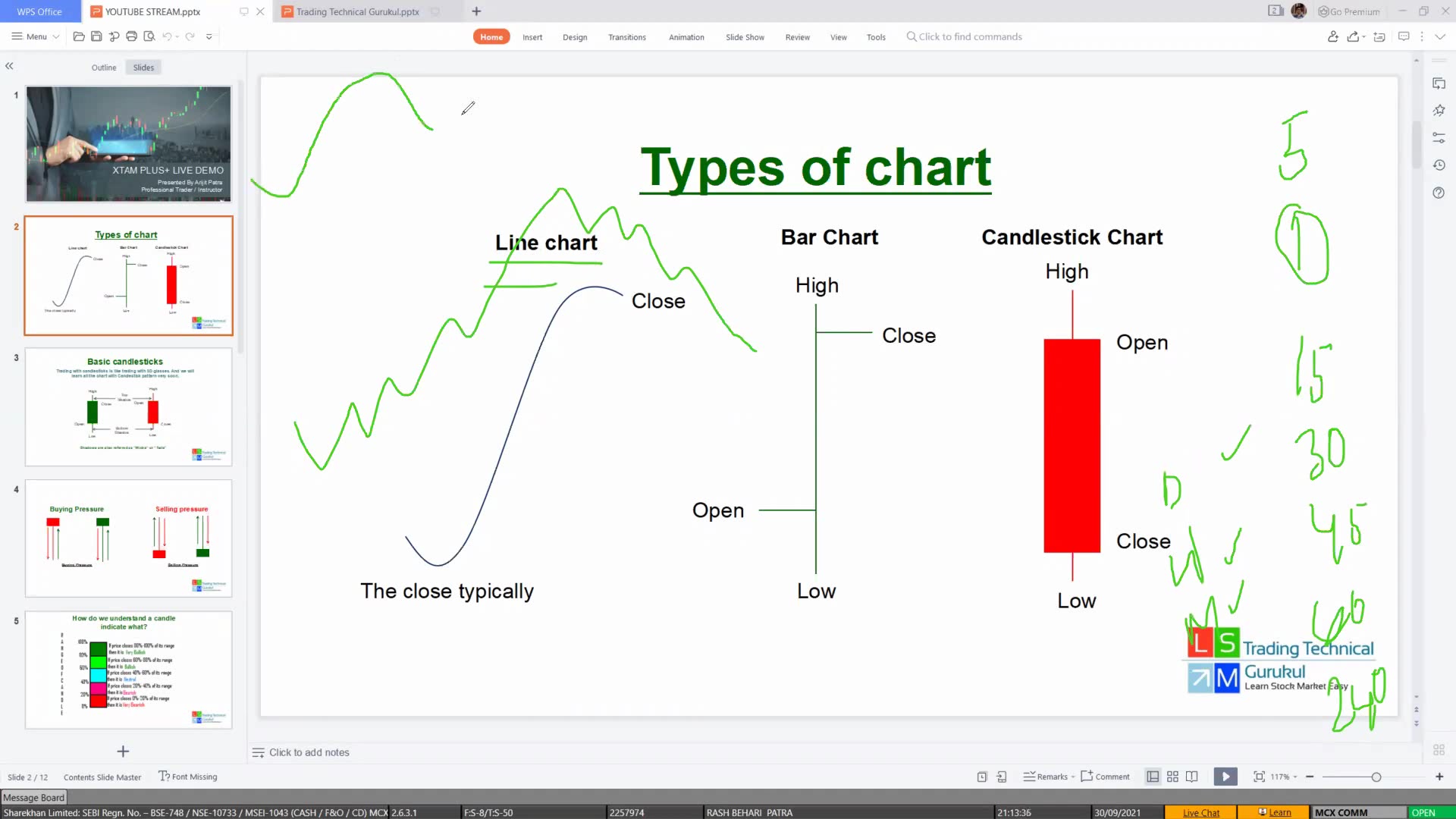

- Price Action Basics & Candle Sticks Basics

- How to identify Support and Resistance?

- How to Draw Trend Lines Horizontal and Vertical?

- OI, Max Pain, and PCR use

- How to handle & when to increase the lots

- Basics of Implied Volatility, THETA, Delta, Gamma (Imp. for Delta), Vega (imp. for IV)

- How to take advantage of Theta decay on weekend with Selected IV.

- DATA Need to Analysis market

Day 4-6

- Position sizing risk management

- Emotion detachment from the trade

- When to use straddle and when strangles their adjustments in detail

- Selling on Friday buying on Monday

- Selling on Wednesday buying on Thursday

Day 7-12

- Basic strategies to follow in low and normal VIX with their adjustments.

- Iron Condors, types of ICs, And their Adjustments in all types of scenarios.

- Straddle when to deploy the best time and how to manage for our best.

- Strangles when to use and what are the adjustments to when goes wrong.

- Iron Fly when to deploy and what is the best adjustment.

Day 12-15

- My monthly template to trade on monthly basis Includes.

- Calendar Spreads mixed with ICs to handle the volatility.

- Ratio spreads with double buying inside to handle the loss overnight.

- simple ratio spread to deploy every month to earn 2%.

- Double selling single buying hedging.

- How to earn monthly 5 % my template all 6 trade/strategy what I deploy for the whole year every month.

Course Hours: 30-35 Hrs

Price: 10000/-